Long-Term Strategy Focused on Becoming New Generation Digital Champion

Our Axiata 3.0 blueprint is focused on our triple core businesses of Digital Telco, Digital Businesses and Infrastructure that will lead us towards becoming a Digital Champion. Axiata 3.0 drives the execution of strategies we have identified to move from a traditional mobile operator into a Digital Telco; to harness the exponential growth within the four verticals of our digital businesses; and catalyse the expansion of our regional tower company to become a global entity. Our Axiata 3.0 strategy is targeted towards delivering overall, moderate growth and moderate dividend.

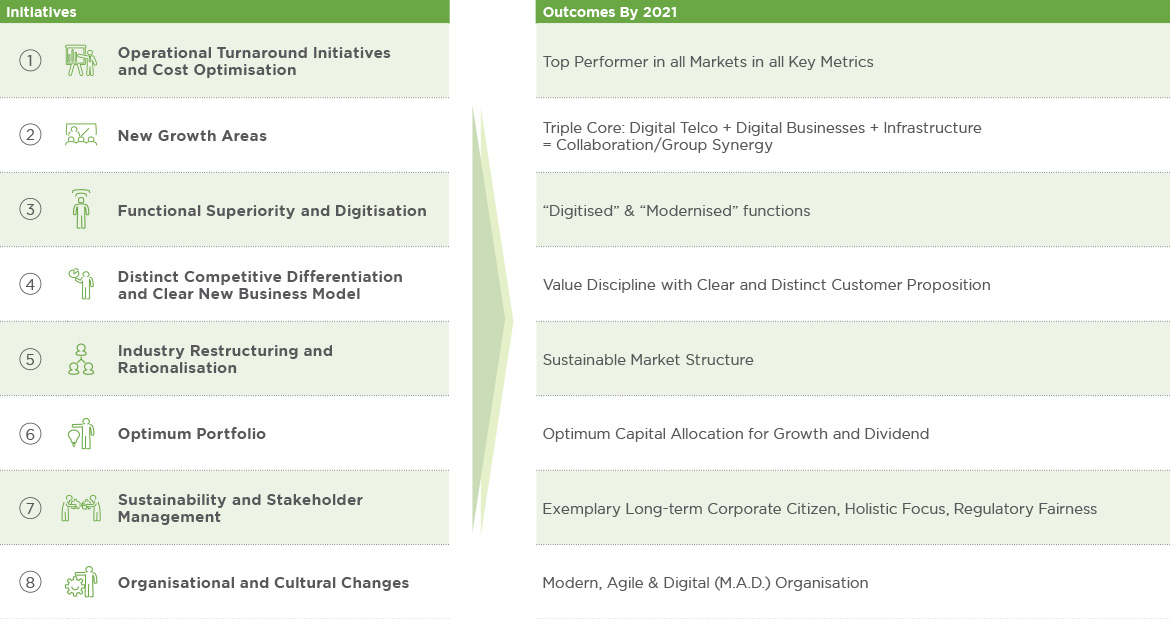

8 Needle-Moving Strategic Initiatives

Based on our Axiata 3.0 blueprint, we have identified 8 needle-moving strategic initiatives to generate outcomes aligned with our New Generation Digital Champion ambition by 2021.

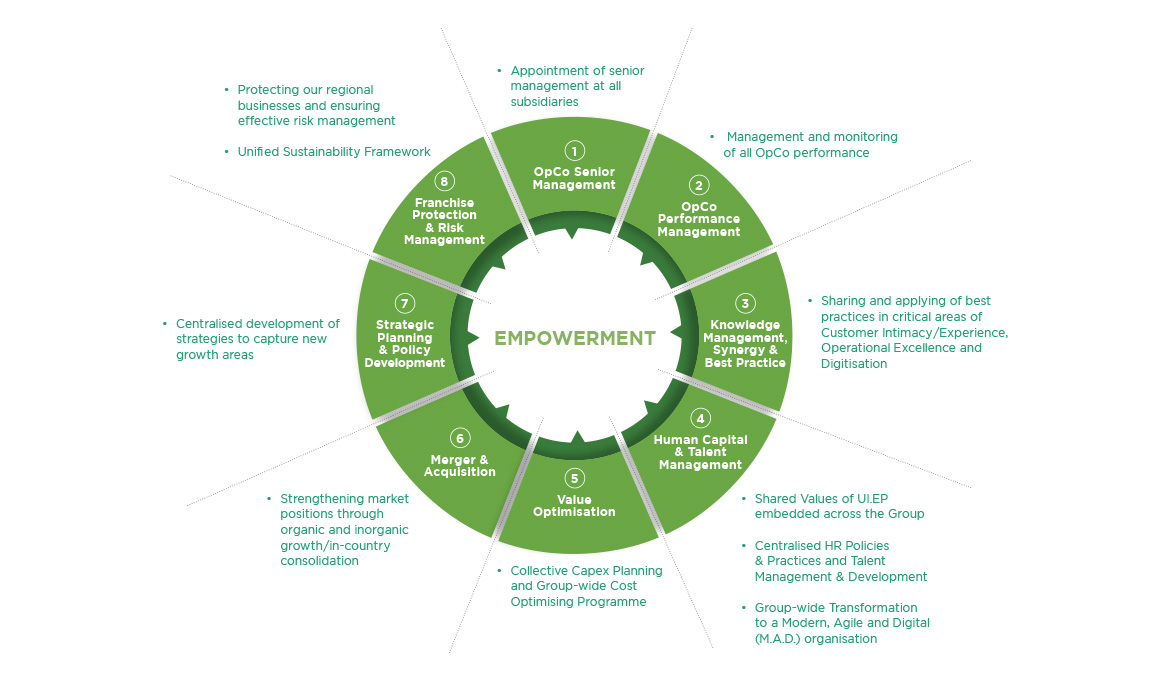

Axiata Engagement Model & 8 Principles

As a telecommunications group with one of the largest and most diverse portfolios of assets in Digital Telco, Digital Businesses and Infrastructure, Axiata operates on a unique engagement model on how it engages and managers the companies under its stake.

The engagement model, developed around eight business critical principles are either centralised or centrally coordinated, as well as standardised and harmonised across the Group. Our engagement model is premised on empowering our businesses and OpCos in implementing our Axiata 3.0 blueprint and our 8 needle-moving initiatives to collectively achieve our ambition of becoming a New Generation Digital Champion.

Embedding Sustainability into our Strategy

In our broader goal of Advancing Asia, Axiata is increasingly committed towards a digitally sustainable and greener future. We are leveraging on our growing presence in ASEAN and South Asia to play a fundamental role in the socioeconomic development of communities in our markets of operation.

Sustainability Framework

Our 4P Sustainability Framework was developed aligned to Bursa Malaysia’s Sustainability Framework. The framework covers our material issues in Economic, Environmental and Social (EES) impacts of our business. The framework has been refined to align with our New Generation Digital Champion by 2021 ambition and stakeholders’ need for greater transparency of disclosure.

Sustainability Governance

The Group Chief Corporate Affairs Officer is responsible for the governance of the Group Sustainability Framework. The Group Sustainability Team, helmed by the Head of Group Corporate Communications and Sustainability, is responsible for the day to day operations. The Sustainability Team ensures compliance of the Group Sustainability Policy, conducts stakeholder engagements, updates material issues, standardises data collection and management systems, and provides advisory support and capacity building to OpCos.

Sustainability Teams at OpCos align and localise the Group’s Sustainability Framework to their national context. They are responsible for the daily operations, implementation of programmes and data collection to support Group’s Sustainability Framework. OpCos are encouraged to produce their own Sustainability Report in compliance with the most current Global Reporting Initiative Standards.

Axiata is a member of the Advisory Council of the Global Compact Malaysia, and a Board Member of the GSMA Foundation, which is committed to the development of mobile innovations that empower and enrich local communities.

Our Operating Environment

Axiata operates within a regional operating environment, marked by the complexities of its 11 individual markets of operations, juxtaposed within the overall global economic and telecommunication industry trends and challenges. In 2017, the Group’s operational businesses and OpCos faced multiple challenges arising from macroeconomic conditions, a shifting regulatory environment, the prevalent digital shift and an intensely competitive landscape.

- 1 Source : “World Economic Outlook Update”, published by the International Monetary Fund in July 2017

- 2 Source : “Economic Snapshot for ASEAN” by David Ampudia, Senior Economist published in FocusEconomics in February 2018

- 3 Source : “South Asia Regional Update”, published by the International Monetary Fund in May 2017

- 4 Source : BMI Research as quoted in the news article “BMI Research: Ringgit to continue to strengthen against USD” published in The Star (Malaysia) on 26 September 2017

- 5&6 Source : “Global Mobile Consumer Survey : Southeast Asia edition”, published by Deloitte published in January 2017

- 7 Source : “Indonesia Country Commercial Guide”, published by the U.S. Department of Commerce’s International Trade Administration

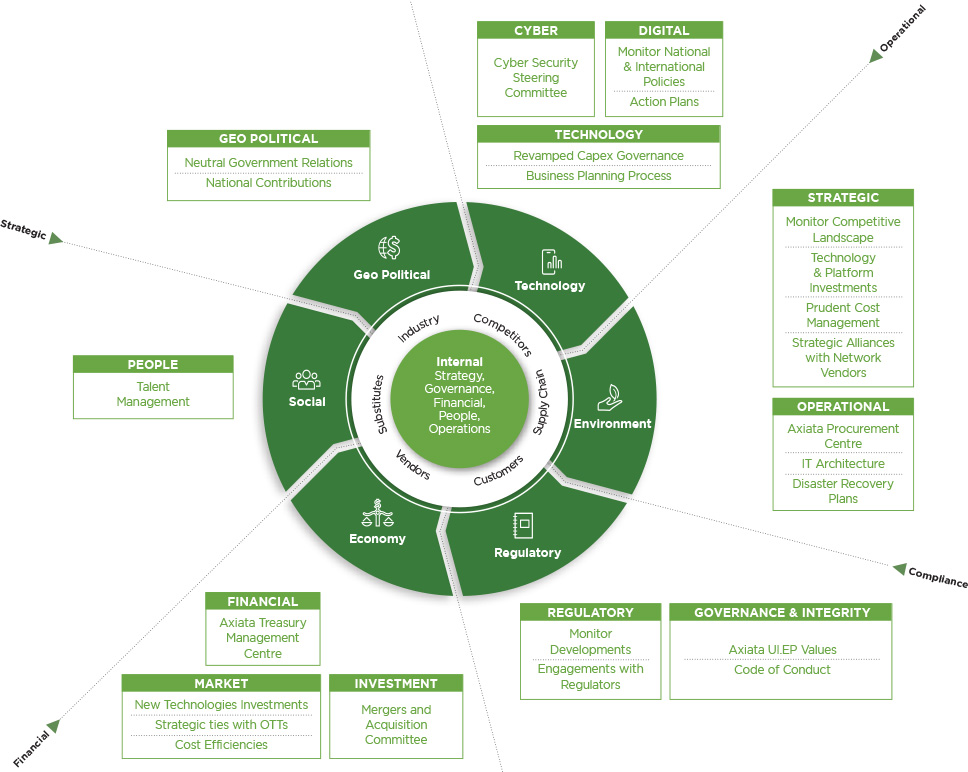

Management of Material Risks and Opportunities

Axiata uses an integrated assurance methodology to manage our risks and opportunities, to catalyse long-term value creation. The following outlines our material risks, along with our Group’s exposure and potential impacts, and identifies mitigation measures which are linked to our Axiata 3.0 strategy and future opportunities.

Stakeholder Engagement

Axiata’s ability to create value relies on successful interactions with our diverse groups of stakeholders. Our stakeholder base cuts across our Group presence in ASEAN and South Asia. Each of our stakeholder groups significantly impact our regional business which sees us within multiple roles including being an employer, communications provider, technology innovator and infrastructure developer.

In order to clearly understand our various stakeholder groups’ concerns and identify the most effective response to issues raised, we conduct continuous, consistent and targeted stakeholder engagement sessions. The outcomes of these sessions informs our material issues, our strategy development, and our risk management.

- Net Promoter Score

- Brand Equity Score

- Social Reputation Score

- Customer experience

- Product affordability

- Network availability

- Continuously enhancing customer experience

- Digitising processes

- Digital self-care apps

- New digital products and services

- Employee Engagement Survey

- Town Hall Meetings

- Career and talent development

- Employee communication

- Group and OpCo Talent Development programmes

- Organisational transformation to Modern, Agile and Digital (M.A.D.) Organisation

- Annual General Meeting

- Investor Roadshows

- Analyst Meetings

- Business performance and strategy

- Total Shareholder Return

- Return on Investment

- Share Price

- Proactive engagements

- Payment of taxes

- National contributions

- Information security

- Spectrum allocations

- Compliance with regulations

- Employment of citizens

- Capex and opex contributions

- Gross Value Added contributions

- Biennial Axiata Supplier Awards

- Annual Supplier Forum

- Supplier Performance Management

- Procurement practices and payments

- Vendor delivery and performance

- Compliance to the Supplier Code of Conduct

- Local vendor sourcing

- Bumiputera Empowerment Agenda

- Axiata Partner Development Programme

- Axiata’s Supplier Code of Conduct

- Media interviews

- Press conferences

- Media releases

- Corporate developments

- Financial performance

- Network updates

- M&A updates

- Triple Core Strategy and performance updates

- News media, social media pages and company website

- Corporate Responsibility Programmes

- Needs assessment of local stakeholders

- Digital inclusion to ensure no one is left behind

- Pre and post disaster assistance

- Building capacity of future leaders

- Addressing social needs

- Disaster Management and Response Initiatives

- Digital and Financial Inclusion Initiatives

- Axiata Young Talent Programme

- Axiata Digital Innovation Fund

- Major contributor to the economies of the markets we operate in