Corporate Governance Overview

The Board of Directors of Axiata Group Berhad (“Board” or “BOD”) is pleased to present the Corporate Governance Overview Statement (“CG Overview Statement”) which provides key highlights on how Axiata complies with the three principles, 32 practices and four Stepups of the Malaysian Code on Corporate Governance 2017 (“MCCG 2017”) during the financial year 2017. This statement has been made in accordance with the authority of the Board dated 22 February 2018 and finalised and updated until the date of the Annual Report (“AR”) 2017 with delegated authority to the Board Annual Report Committee (“BARC”).

This statement is complemented with a Corporate Governance Report (“CG Report”) based on a prescribed format pursuant to paragraph 15.25 of the Main Market Listing Requirements (“MMLR”) by Bursa Malaysia Securities Berhad (“Bursa Securities”). The CG Report is available on the Company’s website https://axiata.com/files/upload/corporate/Corporate_Governance_Report.pdf as well as via an announcement on the website of Bursa Securities. This statement should also be read in conjunction with the Statement on Risk Management and Internal Control (“SORMIC”) and Board Audit Committee (“BAC”) Report as well as other information in the Governance & Audited Financial Statements 2017 (“GAFS”) and Sustainability and National Contribution Report (“SNCR”) accompanying this Integrated Annual Report (“IAR”).

In its vision to become a New Generation Digital Champion by 2021, Axiata has transformed into a Triple Core Strategy of Digital Telco, Digital Businesses and Infrastructure, with long-term value creation opportunities for its shareholders and stakeholders. In the effort to realise this vision, the Board is cognisant of upholding its duties according to the highest principles of accountability and transparency.

The Board remains fully committed to discharging its duties according to the highest standards of corporate governance, whilst pursuing its corporate objectives to enhance shareholders’ value and overall competitive positioning.

The Board recognises the importance of governance and plays an active role in administering and reviewing the Group’s governance practices and framework to ensure its relevance and ability to meet future challenges, as it strives to put in place a strong and effective corporate governance system throughout the Group.

As the sixth largest entity listed on the Main Board of Bursa Securities, the Board has always ensured that Axiata remains at the forefront of good corporate governance. The Group has been recognised consistently for its high levels of disclosures, reporting and upholding the strongest governance. Over the last five years, Axiata has consecutively received accolades at the Minority Shareholder Watchdog Group (MSWG) – ASEAN Corporate Governance Recognition Awards. In 2017, the Group received the following awards:

Tan Sri Datuk Wira Azman Hj Mohktar

for Corporate Governance Disclosure

for Board Diversity

Axiata’s Corporate Governance framework has been developed based on the following statutory requirements, best practices and guidelines:-

Companies Act 2016

(“CA 2016”)

MMLR of Bursa Securities

MCCG 2017

Manual on Enhancing Board Effectiveness by the Putrajaya Committee on Government Linked Companies (“GLCs”) High Performance (Green Book)

Corporate Governance Guide - 3rd Edition issued by Bursa Malaysia Berhad

The culture of upholding strong corporate governance principles is embraced across the organisation led by the Board which sets the tone at the top. The release of the MCCG 2017 by the Securities Commission Malaysia (“SC”) in April 2017 brought about a fresh review of Axiata’s corporate governance practices. Gaps were identified and actions taken to address the same. As at the date of this IAR, Axiata has applied all the practices in MCCG 2017 except for the following:-

- Practice 4.3 - Step Up

The Board has a policy which limits the tenure of its independent director to nine years. - Practice 4.5

The Board discloses in its annual report the company’s policies on gender diversity, its targets and measures to meet those targets. For Large Companies the Board must have at least 30% women directors. - Practice 7.2 and 7.3- Step Up

The Board discloses on a named basis the top five senior management’s remuneration component including salary, bonus, benefits-in-kind and other emoluments in bands of RM50,000.00. Step-up encourages companies to fully disclose the detailed remuneration of each member of senior management on a named basis. - Practice 12.3

Listed companies with a large number of shareholders or which have meetings in remote locations should leverage technology to facilitate:- Voting in absentia; and

- Remote shareholders’ participation at General Meetings.

Clear and forthcoming explanations are provided for departures from the Practices and measures put in place to apply the departed Practices in the CG Report.

A summary of the Group’s corporate governance practices with reference to the MCCG 2017 is described in the following manner:-

Principle A: Board Leadership and Effectiveness - Group Corporate Governance Structure, Board and Board Committees’ Roles and Responsibilities, Board Composition, Effectiveness and Remuneration.

Principle B: Effectiveness Audit and Risk Management - Board Audit Committee and Risk Management and Internal Control Framework.

Principle C: Integrity in Corporate Reporting and Meaningful Relationship with Stakeholders - Communication with Stakeholders and Conduct of General Meeting.

Corporate Governance Framework

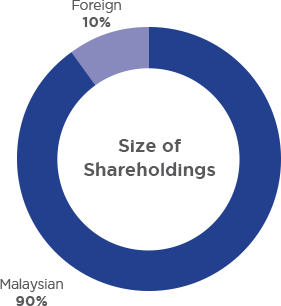

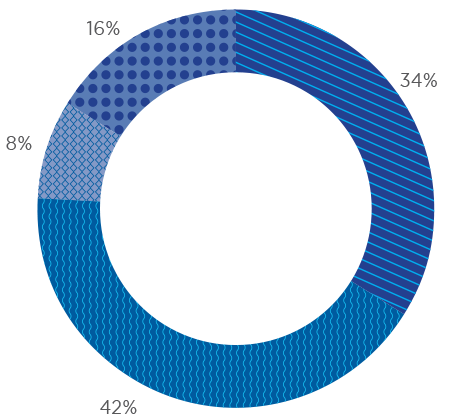

Axiata’s shareholding structure

(As of 31 January 2018)

Board of Directors

Non-Independent

Non-Executive Director (Representative of Khazanah)

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 57 | Malaysian | Male | 3 March 2008 | 10 years |

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 59 | Malaysian | Male | 3 March 2008 | 10 years |

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 72 | Malaysian | Male | 24 March 2008 | 10 years |

KAMALUDIN Senior Independent Non-Executive Director

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 72 | Malaysian | Male | 24 March 2008 | 10 years |

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 55 | Malaysian | Male | 24 Novmeber 2016 | 1 year 4 months |

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 62 | Malaysian | Female | 21 March 2017 | 1 year |

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 65 | Malaysian | Male | 23 April 2008 | 10 years |

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 59 | British | Male | 11 December 2017 | 3 Months |

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 52 | Indonesian | Male | 25 February 2015 | 3 years |

(Representative of Khazanah)

| Age | Nationality | Gender | Date of Appointment | Length of Service |

|---|---|---|---|---|

| 48 | Malaysian | Male | 12 January 2018 | 3 months |

Structural Changes to Board Composition

The year 2017 saw several changes to the Board composition as follows:

- Appointment of Dato Dr Nik Ramlah Nik Mahmood as Independent Non-Executive Director (“INED”) on 21 March 2017;

- Resignation of Bella Ann Almeida as INED on 25 May 2017;

- Appointment of Dr David Robert Dean as INED on 11 December 2017; and

- Appointment of Tengku Dato’ Sri Azmil Zahruddin Raja Abdul Aziz as Non-Independent Non-Executive Director (“NINED”) representing Khazanah in place of Kenneth Shen on 12 January 2018.

Group Senior Leadership Team

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 59 | Malaysian | Male | 3 March 2008 | 10 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 49 | Sri Lankan | Male | 1 January 2017 | 24 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 53 | Indian | Male | 3 April 2017 | 1 year |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 58 | Malaysian | Female | 18 May 2011 | 10 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 50 | Malaysian | Male | 1 March 2013 | 5 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 47 | Malaysian | Female | 1 May 2015 | 5 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 52 | Malaysian | Female | 1 April 2008 | 15 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 62 | Singaporean | Male | 1 June 2011 | 6 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 41 | Australian | Male | 1 March 2016 | 2 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 47 | Indian | Male | 2 November 2012 | 5 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 46 | Malaysian | Male | 1 July 2011 | 6 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 45 | Malaysian | Male | 1 October 2004 | 14 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 50 | Sri Lankan | Male | 1 August 2017 | 7 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 61 | Malaysian | Male | 1 November 2016 | 10 years |

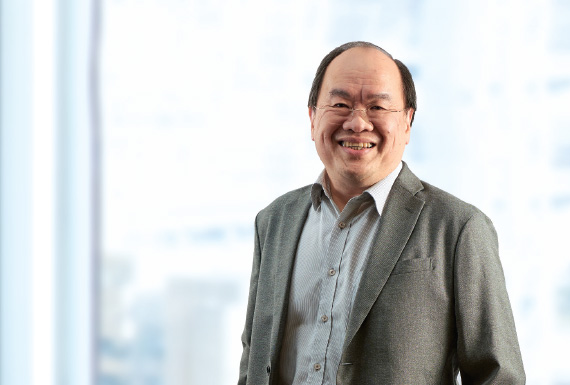

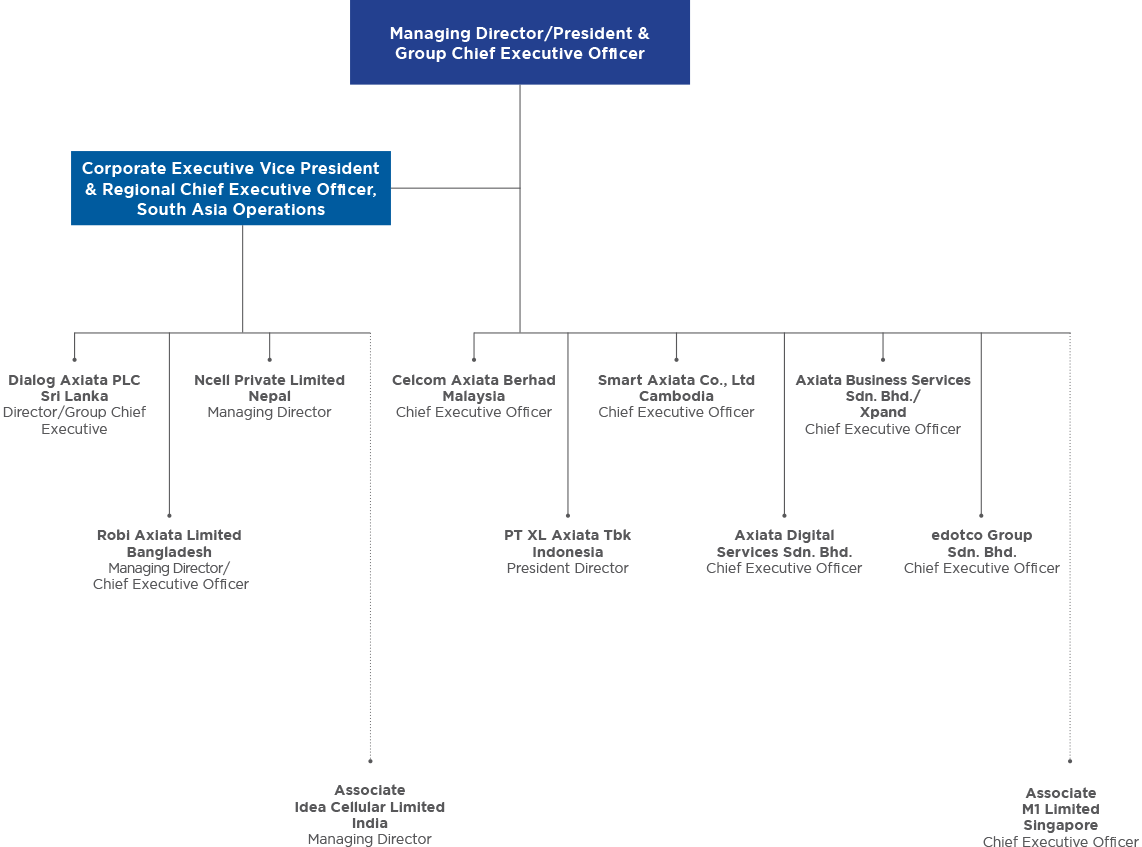

Group Organisational Chart

The Board places great importance in ensuring that Axiata has in place a strong and cohesive Senior Leadership Team (“SLT”) made up of capable individuals who are experts in their own respective fields.

Appointment of top key positions in the Group requires the recommendation of the BNRC and approval of Axiata Board of Directors. A total of 70% of the SLT are from the Axiata footprint and the rest from other countries globally providing a healthy mix of local and foreign nationalities to ensure local and regional knowledge and expertise are balanced with global perspectives.

Several changes were made to the SLT line up in 2017 including the appointment of the Corporate Executive Vice President & Regional Chief Executive Officer, South Asia Operations which allows for better management of operations in view of the growing number of Operating Companies (“OpCo”) in the Group.

A new Group Chief Financial Officer was appointed and the new position of Group Chief Information Officer was filled. The role of Group Chief Information Security Officer was also added reflecting the increasing importance of this area.

Operating Companies’ Management Team

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 66 | German | Male | 1 September 2016 | 5 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 49 | Indonesian | Female | 1 April 2015 | 21 years |

Dialog Axiata PLC

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 42 | Sri Lankan | Male | 1 January 2017 | 18 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 40 | German | Male | 19 February 2013 | 5 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 53 | Sri Lankan | Male | 1 July 2017 | 1 year |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 51 | Bangladeshi | Male | 1 November 2016 | 7 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 47 | Malaysian | Male | 1 January 2015 | 6 years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 51 | Malaysian | Male | 1 January 2018 | 2 Years |

| Age | Nationality | Gender | Date of Appointment to Executive Position | Years of Service at Axiata |

|---|---|---|---|---|

| 51 | Malaysian | Male | 26 August 2014 | 9 years |

Associates’ Management Team

| Age | Nationality | Gender | Date of Appointment to Executive Position |

|---|---|---|---|

| 56 | Indian | Male | 1 April 2011 |

M1 Limited

| Age | Nationality | Gender | Date of Appointment to Executive Position |

|---|---|---|---|

| 63 | Singaporean | Female | 22 April 2009 |

Note:

Years of Service at Axiata refers to tenure within Axiata and its group of companies.

Operating Companies’ Organisational Chart

In 2017 and early 2018, four new CEOs were appointed at the OpCo level. Three of these were internal appointments demonstrating an orderly succession planning in accordance with the Axiata Talent Management Framework. The succession plans are presented to the Board at least twice a year. The plans include talent (both internal and identified external talent) ready to take on senior roles within different time frames and the intervention required for key talent. The succession planning process provides Axiata a ready pool of talent to plan ahead with and when there is insufficient bench strength, to scour the market and identify promising candidates in advance of the anticipated demand.

Board Performance & Effectiveness

Duties & Responsibilities of the Board

The year 2017 saw the Board and Board Committee meeting hours clocking in total 131 hours in the discharge of its key fiduciary duties and leadership functions and responsibilities.

Activities in 2017

- The Board occupied approximately 33% of its time providing the strategic drive for the Company by guiding the SLT in developing the corporate strategy. In pursuit of Axiata’s vision to be a New Generation Digital Champion by 2021, the Board during the mid-year retreat in August 2017 had set the tone and provided direction inter alia in the formulation of the Triple Core Strategy to support Axiata 3.0 Transformation and provide impetus to greater innovation.

- At the year-end retreat in December 2017, the Board deliberated on the Strategic and Annual Business Plan and Budget 2018 and provided feedback and direction before the same was approved at subsequent meeting.

- The Board made several key decisions on matters pertaining to Mergers & Acquisitions (“M&A”) during the year, an area of strategic focus for the Board. Five out of 13 Board meetings were special Board meetings convened on M&A matters.

- The Board oversaw the conduct of the Company’s business and execution of the approved business plan over the short, medium and long-term. 2017 Key Performance Indicators (“KPI”) were set and headline KPIs were announced publicly. On quarterly basis, achievements againsts KPIs were presented and monitored.

- Sustainability and stakeholder management were also topics that constantly cropped up in Board’s deliberations in 2017 as Axiata faced regulatory challenges in many of its footprints. Individual Board members were involved in several high level engagements outside the boardroom in an effort to resolve these issues.

- In terms of the organisation, the Board approved the following proposals in response to changes in the business and industry and in support of Axiata 3.0 Transformation.

Organisation- Nurturing a Modern, Agile & Digital (M.A.D.) organisation.

- Strengthening the OpCo Engagement Model from ‘light touch’ to ‘right touch’: centralised or centrally coordinated.

- Establishing the Analytics Centre of Excellence.

People- Top Management changes across the Group.

- Board refresh and succession planning.

Priorities for 2018

- With a clear vision to be the New Generation Digital Champion by 2021, the Board will continue to refine the Axiata Triple Core Strategy and monitor its execution over the short, medium and long-term.

- Operational turnaround of Axiata’s key OpCos, Celcom and XL will continue to be a key focus.

- Overseeing the execution of the cost optimisation and M.A.D. organisation initiatives.

- Execution of Board refresh and succession planning.

Code of Conduct and Ethics

The Directors Code of Ethics adopted in 2011 were reviewed and replaced with a new Board Code of Conduct and Ethics (“Code”) approved by the Board in February 2018. Adoption of the new Code is to be in line with the practices in the MCCG 2017 and ensures that the Board continues to shape the ethical culture through its leadership. The provisions of the Code are aligned with the Employees Code of Conduct and the corporate culture of uncompromising integrity and exceptional performance applicable across the Group.

Code is available online at https://axiata.com/files/upload/corporate/Board_Code_of_Conduct_and_Ethics.pdf

Board Charter

The Board also approved revisions to the Board Charter (“Charter”) in February 2018. The revisions took into account the gaps in the Charter in view of the provisions of MCCG 2017, inter alia in the following areas:

- Separation of positions of Chairman and President & GCEO. Observed by Axiata from inception with roles of each position clearly defined and now stated as a clear policy.

- Insertion of a specific provision relating to Company Secretary stating the requirement for a qualified person to be appointed and defining his/her roles as advisor to the Board on governance matters to whom the Board shall have unlimited access. Axiata’s Group Company Secretary is a qualified advocate & solicitor and licensed by SSM and hence qualified to act as a Company Secretary under the CA 2016.

- Asserting the Board’s aim to appoint 30% women participation on Board in line with Government aspiration, a target BNRC is actively pursuing.

- Specifically stating the requirement that if the Board wishes to retain an INED who exceeds the cumulative term limit of 9 years, he/she shall be redesignated as NED, unless annual shareholders’ approval is sought for him/her to remain as INED providing justifications.

The full extent of the Board’s responsibilities is available in the Board Charter at https://axiata.com/files/upload/corporate/Board_Charter.pdf

Note:

As the Board is executing its phased retirement plan for INEDs appointed in 2008 from 2016- 2020, where one INED will retire each year instead of all at the same time to ensure continuity and stability, it is not possible at this point to adopt a nine-year term limit for INEDs. Axiata INEDs are however not expected to serve as independent beyond 12 years.

Directors’ Profesional Development and Education

Other than the Mandatory Accreditation Programme (“MAP”) prescribed by Bursa, all newly appointed Directors of Axiata attended an induction programme held before they attend their first Board meeting.

Axiata has a dedicated budget for Board training and a set of guidelines on Board Training Programmes. BNRC undertakes an assessment of the training needs of the Board and each Director and reviews the same on half yearly basis.

The training programmes attended by each of the Director in 2017 are listed on pages 20 to 21 of the GAFS.

2017 Directors’ Training Areas

Board Composition

Board Size and Composition

Axiata has in place a Board Composition Framework which takes into consideration, among others, complexity and geographical spread of the Groups businesses.

- Maximum of 10 Board members (up to two Executive Directors (EDs). In recent discussions, the Board indicated a possibility that the Board composition may be larger than 10 in view of the new businesses and allowing a certain duration for Board transition and refresh;

- Two NINEDs representing Khazanah as the major shareholder;

- More than 50% of the Board to comprise Independent Non-Executive Directors (INEDs) with various mix of skills, experience and diversity including in terms of nationality and gender; and

- Up to three members with geographical experience matching Axiata’s footprint (Indonesia/Indian sub-continent/international).

Current composition of Axiata Board has the appropriate mix of diversity, skills, experience and capabilities.

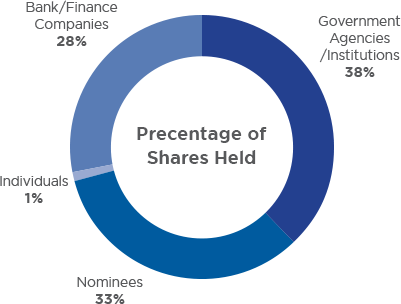

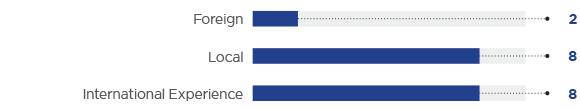

NINED/INED/ED & Gender

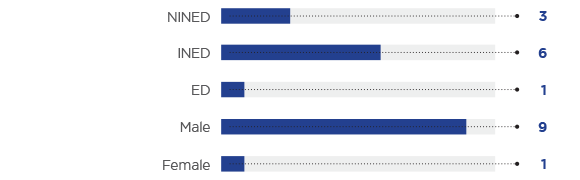

Industry Experience

Functional Experience

Geographical Experience

The breadth of skillsets and experience of Axiata Board is instrumental to guide Axiata through the next phase of its transformation journey. Thus, the BNRC and the Board are currently actively searching for suitable candidates to strengthen the gender balance and further enhance the Board composition. Priority is to find a female candidate with IT/Digital/Entrepreneur type of experience followed by HR and/or Government relations. Candidates are sourced through the following channels:

- Internal recommendations

- Women directors pool maintained by LeadWomen and Institute of Corporate Directors Malaysia (“ICDM”).

- Appointment of an international recruitment firm

Axiata has a clear and transparent process for selection, nomination and appointment of suitable candidates to the Board of Axiata as described below:-

2017 Meeting Calendar

The overall calendar of meetings of the Board and Committees held in 2017 and attendance of the respective Directors are provided below:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sept | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BOD | • | • | • Special • Special |

• | • | • Special |

• Mid-Year Strategy Retreat • Special • |

• Special • |

• 2-day business planning |

|||

| BAC | • | • | • Special |

• | • | • | ||||||

| BNC | • | • | • Special |

• | • | • | ||||||

| BRC | • | • | • Special |

• | • | |||||||

| AIOB | • | • | • | |||||||||

| BARC | • | • | • • • |

• |

| Board (13) | BAC (6) | BNC (6) | BRC (5) | AIOB (3) | BARC (6) | |

|---|---|---|---|---|---|---|

| Tan Sri Datuk Wira Azman Hj. Mokhtar | 13/13 (100%) | - | - | - | - | - |

| Tan Sri Jamaludin Ibrahim | 13/13 (100%) | - | - | - | 3/3 (100%) | 4/6 (67%) |

| Tan Sri Ghazzali Sheikh Abdul Khalid | 13/13 (100%) | - | 6/6 (100%) | 5/5 (100%) | - | - |

| Datuk Azzat Kamaludin | 12/13 (92%) | 6/6 (100%) | 5/6 (83%) | 4/5 (80%) | - | 5/6 (83%) |

| Dato’ Mohd Izzaddin Idris | 11/13 (85%) | - | - | - | 3/3 (100%) | - |

| David Lau Nai Pek | 13/13 (100%) | 6/6 (100%) | - | - | 3/3 (100%) | 6/6 (100%) |

| Dato Dr Nik Ramlah Nik Mahmood* | 9/9∞ (100%) | - | - | - | - | - |

| Dr David Robert Dean** | 1/1∞ (100%) | - | - | - | - | - |

| Bella Ann Almeida*** | 4/6 (67%) | - | 3/4 (75%) | 3/5 (60%) | - | - |

| Dr Muhamad Chatib Basri | 11/13 (85%) | - | - | - | - | - |

| Kenneth Shen | 12/13 (92%) | 4/6 (67%) | 6/6 (100%) | 5/5 (100%) | 2/3 (67%) | 4/6 (67%) |

* Appointed on 21 March 2017

** Appointed on 11 December 2017

*** Resigned on 25 May 2017

∞ Number of Board meetings attended from appointment

Board Effectiveness

Board Effectiveness Evaluation (“BEE”)

Similar to the previous years, BNRC appointed an experienced third party, ICDM as facilitator to facilitate its 2017 BEE. The Board believes that an independent party will lend greater objectivity to the assessment process.

A refresher approach based on similar set of criteria and questionnaires were used for the Board to provide their ratings in the following areas measured:-

Board

- Group Dynamics and Effectiveness.

- Overall impressions of the Board

- Effectiveness, Involvement and engagement, Structure and composition.

- Board Organisation – Agendas, meeting frequency, quality, structure and timeliness of Board materials, discharge of duties, adequacies of time for deliberations, information and support materials, strategic oversight, balance, size, gender diversity, skillsets, independence elements.

- Board Committees – Organisation, agendas, meeting frequency, performance of members, size, balance of topics discussed and adequacies of report to Board.

- Succession Planning and Development.

- Communications.

Self-Peer

- Knowledge and understanding on strategy, market, critical success factors, business risk, performance measures, financial discussions, awareness, risk management, skills and experience.

- Analytical skills.

- Preparation for Board meetings, time commitment and commitment to professional development.

- Independence

- Ability to speak openly, and ability to demonstrate independence exemplified by impartiality, objectivity and consideration of all stakeholders’ interest.

Based on the findings of the 2017 BEE tabled to the Board at its meeting on 27 March 2018, the key themes from the previous years continue to apply. Axiata Board is seen as well run, with an experienced Chair who facilitates constructive challenge and healthy discussion of critical issues. The quality of discussion is high, with a robust exchange of views, appropriate comments and suggestions. Directors are also committed to the highest standards of corporate governance.

On the areas of improvement, pressing need to meet the gender diversity target was highlighted, however, the Board also noted that the matter was being actively looked into by BNRC. Other items requiring attention were also noted and would be appropriately addressed by the Board. In respect of the directors standing for re-election, the BNRC took into consideration the self-peer ratings and other feedback on the areas evaluated.

Tan Sri Datuk Wira Azman Hj. Mokhtar, as a NINED, has always scrupulously put the interests of Axiata first, while representing the perspectives of Axiata’s shareholder, Khazanah Nasional Berhad where he is the Managing Director. He provides invaluable, objective input to the Board’s strategic thinking processes, reconciling the long-term and short-term priorities of both, Axiata and Khazanah with its “patient capital” philosophy. He is a highly effective Chairman of the Board, providing strong, dynamic and efficient leadership, while at the same time ensuring a collegial atmosphere where directors are encouraged to challenge constructively in a spirit of “disagreeing without being disagreeable”. He is good at sensing the consensus of the Board and is willing to be overruled. He does not tolerate factionalism, emphasising the importance of the integrity of discussions of the Board and its collective responsibility. The Board is of the view that Axiata is fortunate in having such a Chairman and recommends his re-appointment as a NINED.

Tan Sri Ghazzali Sheikh Abdul Khalid achieved the maximum score for independence of thinking, based on the BEE ratings by his peers. This is the result of being rated highly on his understanding of his role as an INED and on the role of the Board in governing Axiata. Collegial in nature, he is able to challenge constructively through his objective chairing of Board committees and his contributions affecting discussions regarding management which are enhanced by his long period of service with Axiata, which has not affected his impartiality and objectivity. The Board is of the view that he should remain as an INED and recommends his re-appointment.

David Lau Nai Pek achieved the maximum score for his independence of thinking based on the BEE ratings by his peers, resulting from his professional financial expertise as an accountant who is thorough, detailed, precise and uncompromising in addressing issues before the Board, with characteristic independence and impartiality. His years of service on the Axiata Board provide a stronger basis for being able to constructively challenge management on the financials and performance measures. The Board believes he is a high-performance Board member, able to reconcile the need to support and challenge management on assumptions regarding strategy, capex and profitability, as well as monitoring results. The Board is of the view that he should remain as an INED and recommends his re-appointment.

Datuk Azzat Kamaludin will retire under Article 93 of the Company’s Articles of Association and will not be seeking re-election.

The assessment in respect of Directors independence in 2017 BEE was carried out using the criteria prescribed under the MMLR of Bursa Securities. Under individual Director Peer and Self-Review INEDs are essentially assessed based on the spirit, intent, purpose and attitude of each INED as well as readiness to challenge and debate which is considered as exhibiting independent judgement and ability to act in the best interest of Axiata.

Board Remuneration

Non-Executive Directors (“NED”)

As a regional company, the remuneration philosophy is to develop a remuneration structure that commensurates with the Directors responsibilities at both Board and Board Committee level and is sufficient to attract, incentivise and retain quality Directors. The remuneration packages differentiate the Chairman and ordinary members of the Board and Board Committee to reflect the bigger role played by the Chairman. The last review of the remuneration structure was undertaken in 2014. Since the Board is targeting a five-yearly review, the next review is due to be held in 2019.

The following table outlines the remuneration structure for NEDs of the Group:-

| Remuneration | Monthly Fees1 (RM) | Meeting Allowances2 (RM) | |||

|---|---|---|---|---|---|

| NEC3 | NED | NEC3 | NED | ||

| BOD | 30,000.00 | 20,000.00 | 3,000.00 | 2,000.00 | |

| BAC | 4,000.00 | 2,000.00 | 3,000.00 | 2,000.00 | |

| BNC | 1,200.00 | 800.00 | 1,500.00 | 1,000.00 | |

| BRC | 1,200.00 | 800.00 | 1,500.00 | 1,000.00 | |

| Other Board Committees | Nil | Nil | 1,500.00 | 1,000.00 | |

- In accordance with shareholders’ approval, Axiata pays Board and Board committees’ Directors’ fees on a monthly basis

- Meeting allowances are paid on a per meeting basis, notwithstanding any adjournment and number of days

- NEC refers to Non-Executive Chairman

Benefits

Benefits such as annual overseas business development trips, leave passage, travel allowance, travel allowance for non-resident NEDs, equipment, telecommunication facilities, insurance and medical.

Executive Director (“ED”)

The Company’s policy on remuneration for the ED is similar to previous years which is to ensure that the level of remuneration is generally set to provide market competitiveness to attract, retain and motivate an ED of the highest calibre to competently manage the Company.

The remuneration is therefore structured to link various components of the package with corporate and individual performance as well as Total Shareholder Returns (“TSR”). It also takes into account similar packages at comparable companies (of similar size and complexity to Axiata locally; and in the same industry in the region), based on information prepared by independent consultants and survey data.

The current remuneration policy of the ED consists of basic salary, benefits-in-kind and EPF contributions, as a guaranteed component. On top of this, the ED is eligible for two types of performance-based incentives which are the Short-Term Incentive Plan (“STIP”) linked to a particular financial year’s targets and the Long-Term Incentive Plan (“LTIP”) which is linked to a 3-year long-term target.

For the STIP, the performance of the ED is measured based on the achievements of his annual KPIs. These KPIs comprise not only quantitative targets, such as annual revenue, EBITDA, PATAMI or Return on Invested Capital (“ROIC”) and relative performance of the OpCos, but also qualitative targets which include strategic milestones and initiatives that need to be achieved and implemented in a given year, on areas such as strategy, innovation, business development, synergy, human capital management, financial management and societal development. The weightage of the qualitative and quantitative targets may be adjusted to accommodate the Group’s aspirations.

For the LTIP, the performance of the ED is measured on the achievement of a combination of TSR and ROIC within the vesting period; TSR targets being set in comparison with other high-performing companies on Bursa Securities.

Board Committees

Board Nomination & Remuneration Committee

Members

Tan Sri Ghazzali Sheikh Abdul Khalid (Chairman) (INED), Datuk Azzat Kamaludin (Senior INED), Dato Dr Nik Ramlah Nik Mahmood (INED)Roles

Nomination

- Oversee the selection and assessment of Directors and ensure that Board composition meets the needs of Axiata;

- Propose new nominees to the Board of Directors of Axiata and any Committee of the Board;

- Facilitate and review Board induction and training programmes;

- Assess Directors on an ongoing basis; and

- Recommend or approve, as the case may be based on the terms of reference herein, the key management of Axiata Group.

Remuneration

- Recommend to the Board the remuneration of the EDs in all its forms, drawing from outside advice as necessary;

- Assist the Board in determining the policy and structure for the remuneration of Directors and Senior Management of Axiata Group; and

- Administer the ‘Performance-Based Employee Share Option Scheme and Share Scheme’ (“Axiata Share Scheme”) in accordance with the Bye-Laws of the Axiata Share Scheme (“Bye-Laws”) as approved by shareholders of the Company.

Activities in 2017

Nomination

- Undertook a fresh review of Axiata Board composition and identified gaps created as a result of the execution of phased retirement plan for INEDs who have reached the nine-year cumulative term limit in 2017 from 2016-2020.

- Recommended the appointment of Dato Dr Nik Ramlah as INED in a process that involved the engagement of an external recruitment firm.

- Twice during the year reviewed reports on directors training including making recommendations thereof.

- Reviewed changes proposed in respect of the nomination of Axiata nominee directors on OpCo Boards.

- Reviewed and recommended the extension of employment contracts of key personnel of Axiata Group.

- Discussed the findings of the 2016 BEE and follow-up actions and approach for 2017 BEE.

- Recommended the appointment of Board Committee members and other changes as a result of Group Governance Review.

- Recommended the amalgamation of BNC and BRC into a single committee, BNRC effective 1 January 2018.

- Recommended the establishment and membership of a new Board Committee, BRMC.

- Succession Planning and Talent Management Review.

- Reviewed the suitability of the directors due for re-election at 2017 AGM.

- Assessed and recommended the three INEDs who have exceeded the nine-year cumulative term limit to continue serving as independent.

- Recommended the appointment of Dr David Robert Dean.

Remuneration

The BRC considered and recommended to the Board the following matters:

- Long-Term Incentive Plan (“LTIP”) for Axiata and Axiata Digital Services Sdn Bhd.

- Revision of Group Performance Bonus Matrix.

- Long-Term Incentive Grant for edotco Group Sdn Bhd.

- GCEO KPI2016 - Performance Evaluation and Remuneration.

- Company Bonus Payment and Salary Review Budget.

- 2017 Restricted Share Plan Grant and Vesting.

Priorities for 2018

Nomination

- Immediate priority is to achieve the 30% women’s participation on Board by end 2018. In doing so, to find suitable candidates that will also address the skillset gap in Board composition. BNRC has appointed an international recruitment firm to assist in the process.

- To continue overseeing a transparent and orderly execution of Board phased retirement plan and Board refresh.

- Review of top Management succession planning.

- Evaluate the need for a Comprehensive BEE last carried out in 2013 and consider the practicality of rolling out on Group-wide basis.

- Monitor follow-up actions based on 2017 BEE findings.

- Other routine or new matters proposed by Management/Board.

Remuneration

- Routine matters such as:-

- Performance Bonus and Increment for employees;

- LTIP for Axiata and its subsidiaries;

- Proposed Headline KPIs for GCEO; and

- Proposed Company Bonus Payment and Increment and others

- Decide on the process for the review of NED remuneration due for tabling in 2019.

The ToR of the BNRC is available online at https://axiata.com/files/upload/corporate/Terms_of_Reference_Board_Nomination_and_Remuneration_Committee.pdf

Axiata Digital Business Investment and Oversight Board Committee

Members

Dato’ Mohd Izzaddin Idris (Chairman) (NINED), David Lau Nai Pek (INED), Tan Sri Jamaludin Ibrahim, Dr David Robert Dean (INED), Tengku Dato’ Sri Azmil Zahruddin Raja Abdul Aziz (NINED), Dr Hans Wijayasuriya, Mohd Khairil Abdullah, Javier Santiso, Greg TarrRoles

- Approve investments in digital business up to USD20 million, provided that the approved investment is within the budget approved by Axiata Board

- Perform the oversight function on investments made under the ambit of AIOB approval.

- Approve divestment of digital business up to USD20 million provided it was an investment previously approved by AIOB.

Activities in 2017

- Previously known as Axiata Investment Board Committee (“AIB”), the committee made key investment decisions relating to Digital Financial Services, Digital Advertising, Enterprise Solutions/IoT and Digital Platforms within its Limits of Authority (“LoA”).

Priorities for 2018

- The role of AIOB has been enhanced to include oversight function on investments made under its purview. The ToR has also been amended to include decisions on divestments within the same limit of USD20 million.

- With the above changes, AIOB will focus on the discipline of tracking the performance of the business against their original business case and to make appropriate decision and/or recommendation in a timely manner.

Board Annual Report Committee

Members

David Lau Nai Pek (Chairman) (INED), Tan Sri Jamaludin Ibrahim, Datuk Azzat Kamaludin (Senior INED)Roles

- Review and approve the content design, concept and structure of the IAR and other related reports.

- Review and approve the overall content of the IAR and ensure compliance with the MMLR of Bursa Securities.

- Review and recommend for the Board’s approval of related statements in the IAR as required by the MMLR, some of which may require prior review by the Board Audit Committee or other Board Committee of Axiata.

- Review and recommend for the Board’s approval additional disclosures to be made in the IAR taking into account the Company and Group’s position at any particular time and set the best disclosure framework to reflect the performance and image of the Company which is vital to the shareholders and stakeholders who are the ultimate recipients of the IAR.

Activities in 2017

- To provide a holistic view of the Group’s business and how value is created, the Board has recommended the adoption and application of the globally recognised and best practice reporting framework of the International Integrated Reporting Council’s (“IIRC”) Integrated Report.

- Initiated discussion on applying the IIRC’s Integrated Reporting framework as the framework in Axiata’s IAR to shareholders and stakeholders.

- Engaged with consultants, professional bodies and stakeholders to develop a roadmap towards applying the IIRC framework for its IAR.

- Conducted reviews of Axiata’s inaugural IAR.

Priorities for 2018

- In 2017, Axiata developed its inaugural IAR. Within the next three to four years, the Board targets to apply 100% of the Integrated Reporting framework.

- To improve on the IAR reporting process.

The ToR of the AIOB and BARC are available online at https://axiata.com/files/upload/corporate/Terms_of_Reference_Axiata_Digital_Business_Investment_and_Oversight_Board_Committee.pdf and https://axiata.com/files/upload/corporate/Terms_of_Reference_Board_Annual_Report_Committee.pdf respectively.

Board Audit Committee

Board Audit Committee (“BAC”)

Members

David Lau Nai Pek (Chairman) (INED), Datuk Azzat Kamaludin (Senior INED), Dr David Robert Dean (INED)BAC currently comprise of wholly INED and its Terms of Reference (“ToR”) has been recently reviewed to require a former key audit partner to observe a cooling off period of two years before being appointed as an BAC member.

All BAC Members are financially literate, well above the level needed for an Audit Committee. Their appointments are made by the Board on the recommendation of the BNRC and in consultation with the BAC Chairman.

Group Chief Internal Auditor (“GCIA”) acts as the Secretary of the BAC and meeting dates are synchronized to coincide with the key dates within the financial reporting and audit cycle with ample time for a report to be prepared for the Board, particularly on irregularities and significant finding on matters of concern.

Axiata’s internal audit function reports directly to the BAC and the Internal Audit (“IA”) Charter is also approved by the BAC.

Board Audit Committee

Roles

- Assist the Board in fulfilling its statutory and fiduciary responsibilities.

- Review financial statements and financial reporting process, system of internal controls, audit process and process for monitoring compliance with law and regulations including Bursa Malaysia requirements and the Company’s Code of Conduct.

Activities in 2017

- Reviewed the Group gearing status and portfolio rebalancing, hedging and forex policies, currency exposure and cash management of the Group.

- Reviewed and approved all Related Parties Transactions (“RPT”) in particular:

- the salient terms of the Share Purchase Agreement between Axiata and Khazanah in relation to the fund-raising exercise by edotco to raise up to USD700 million.

- the proposed acquisition of Webe Target assets such as roof-top tower portfolio/ tenancies.

- Reviewed Axiata Digital investment portfolio including the accounting impact by asset/portfolio.

- Reviewed the proposed policy on “put option” in M&A deals, and recommended to the Board for approval.

- Reviewed and approved the improvement plan for the fraud and investigation function across the Group.

- A Cyber Security Forum initiated by the Cyber Security Steering Committee (“CSSC”) was held on 2nd May 2017 attended by OpCos’ BAC Chairmen and Board Audit Committee Senior Management of Axiata and Opcos to discuss the Cyber Strategy as well as progress of improvement initiatives for 2017. This includes the status of improvement initiatives to address the critical issues highlighted in the security review – Cyber Security Posture Assessment (“CSPA”).

- An Axiata BAC Chairman Forum was conducted on 19 September 2017 addressing the common challenges faced by Group Operating units arising from the Axiata Triple Core Strategy focusing on operational turnaround initiatives and cost optimisation, new growth areas and transforming into a M.A.D. organisation. There was also an update on MFRS 9 – Financial Instruments and its impact on the financial statements to ensure consistent adoption across the Group.

- The BAC Chairman visited Ncell in Nepal to understand the challenges faced by Ncell’s management in operating in a challenging political environment as well as to provide the BAC’s perspective on governance and controls.

- Reviewed and approved the revised ToR of the BAC due to the MCCG 2017 introducing “Step-up” practices (MCCG Step-up 9.3) which led to the set up of a BRMC to oversee the company’s risk management framework and policies (previously under the BAC).

- A total of 110 internal audit reviews were completed across the Group.

- Reviewed the financial results quarterly, half yearly and annually prior to tabling the same to the Board for approval.

- Reviewed the potential impairment exposure of major investments.

- Held two private meetings with the external auditors on 12 February 2017 and 28 August 2017 without the presence of management.

- Reviewed 16 business control incidents and identified cases of control weaknesses including fraud for sharing of lessons learnt within the Group to avoid similar incidents.

- Acknowledged, reviewed and investigated 22 defalcation cases across the Group.

Priorities for 2018

- Improve the process for review of the accounting impact of M&A deals, particularly where derivatives are employed including the use and accounting for options.

- Increase the ongoing focus of potential impact on financials arising from divestments, in-country consolidation and M&A. In particular, in 2018 the focus will be on reviewing the potential impairment of Axiata’s investment in Idea following the completion of the merger which will result in dilution of the Group’s stake from associate to simple investment.

- Continue to review the Group foreign currency exposure, the impact of currency translation on Axiata Group’s financial statements, debt level including restructuring where necessary and dividend policy.

- Review the progress and reporting of cost savings under Axiata Group’s Cost Optimisation project.

- “Digitising” the internal audit progress, to experiment the use of data analytics for wider sampling in internal audits.

- Ensure adoption of recently introduced International Accounting standards across the Group, such as MFRS 9 and MFRS 15.

- To attract more Axiata talent across the Group to join IA to ensure a healthy rotation of auditors and audit managers across the Group.

The ToR of the BAC is available online at https://axiata.com/files/upload/corporate/Terms_of_Reference_Board_Audit_Committee.pdf

Review of the performance of the BAC

Review of the performance of the Board Committees including the BAC form part of the annual BEE. The scope included appropriateness of meeting agenda, frequency and whether committees perform at the level expected by the Board. Also evaluated were the appropriateness of the size of the committees, selection of attendees and whether reporting to the Board was adequate. The self and peer review evaluated individual Directors performance and the BEE questionnaire included comments section inviting specific comments including on committees and members.

For the 2017 BEE, the findings showed general improvement across the board on Board committee organisation and performance. In respect of areas of improvement for the BAC, reporting to the Board could be more comprehensive on key issues. Other than a general proposal to rotate Board committee members, no other concern was raised on performance of individual members.

Relationship with Auditors

2017 saw the continued consultation and dialogue between BAC, IA and Finance and the external auditors. These discussions are always held in a professional manner with different views tabled and discussed openly, and where the auditors are given access to all information.

In 2018, the BAC and Group finance will look at improving the process for the consolidation of OpCos results for quarterly and annual reports, allowing increased time for external auditors to do their audit in a timely and professional manner.

Whistleblowing Policy

The Group has a Whistleblower Policy which enables employees to raise matters in an independent and unbiased manner. As part of this Whistleblower Policy and procedures, there is an anonymous ethics and fraud email, under the administration of the Group Chief Internal Auditor (GCIA), as a mechanism for internal and external parties to channel their complaints or to provide information in confidence on fraud, corruption, dishonest practices or other similar matters by employees of the Group. The objective of such an arrangement is to encourage the reporting of such matters in good faith, with the confidence that employees or any parties making such reports will be treated fairly, their identity remains anonymous and are protected from reprisal.

Dedicated Whistleblowing email address: [email protected]

Internal Control & Risk Management

Board Risk Management Committee (“BRMC”)

Members

David Lau Nai Pek (Chairman) (INED), Dato Dr Nik Ramlah Nik Mahmood (INED), Dr David Robert Dean (INED), Peter ChambersBRMC was established effective 1 January 2018 after deliberating on the Step-up 9.3 provision of MCCG 2017. The Board recognised the advantage of having a Board committee separate from the audit committee to focus on risks in the complex and ever changing business landscape.

BRMC takes over from the BAC the role of assisting the Board in evaluating the adequacy of risk management framework.

BRMC which comprises of a majority of INEDs, has the advantage of also having the GCEO as well as a Board representative from a major OpCo as members, thus providing a platform for a more holistic and robust discussion on risks across the Group.

Board Risk Management Committee

Roles

- Review and recommend the risk management methodologies, policies (including framework) and risk tolerance levels for the approval of the appropriate authority in accordance with Axiata LoA and its strategy.

- Review and assess the adequacy of the governing policies, framework and structure in place for managing risks as well as the extent to which these are operating effectively.

- Ensure adequate infrastructure, resources and systems are in place for effective risk management. This includes ensuring that the staff responsible for implementing risk management systems perform their responsibilities independently of the risktaking activities.

- Review the management’s periodic reports on risk management activities, risk exposure and risk mitigating actions.

Activities in 2017

The committee has been established effective 1 January 2018.Priorities for 2018

- Settling into its role as a newly established Board committee and understanding its areas of focus such as business continuity management and promotion of a healthy risk culture.

- Define and recommend Axiata Group’s risk appetite.

- Keeping abreast with new and emerging risks and mitigation.

- Review from time to time and focus on top 10 key risks affecting the Group and the actions taken to mitigate them.

- Execution of Cyber Security Risk Roadmap.

Axiata maintains a high level risk register and the same is reviewed and updated every quarter. This comprises risks specific to the divisional activities of the business as well as more Group-wide risks affecting its long-term strategy and vision.

The Group has established the ERM framework as a standardised approach to rigorously identify, access, report and monitor risks facing the Group. The framework, benchmarked against ISO 31000:2009, is adopted across the Group. Based on the ERM framework, a risk reporting structure has been established to ensure prompt communication to BRMC and the Board.

The ToR of the BRMC is available online at https://axiata.com/files/upload/corporate/Terms_of_Reference_Board_Risk_Management_Committee.pdf

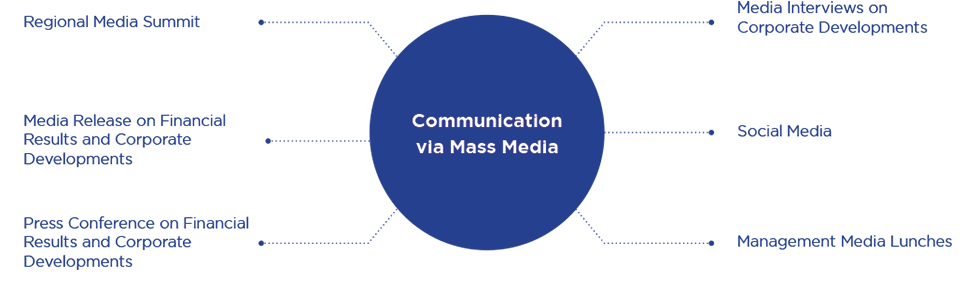

Communication with Stakeholders and Investors

Communication with Shareholders and Investors

The Board acknowledges the importance of effective communication channels between the Board, stakeholders, institutional investors and the investing public at large to provide a clear and complete picture of the Group’s performance and position as much as possible. The Group is fully committed in maintaining high standards in the dissemination of relevant and material information on the development of the Group in its commitment to maintain effective, comprehensive, timely and continuous disclosure. There has also been strong emphasis on the importance of timely and equitable dissemination of information. Disclosures of corporate proposals and/or financial results are made not only in compliance with the MMLR of Bursa Securities but also include additional items through media releases and are done on a voluntary basis.

This equitable policy is not only prevalent to financial affairs but also extended to major and/or strategic transactions. Audiocasts of analyst calls on quarterly results and major and/or strategic transactions are also made available on Axiata’s website.

Axiata uses a number of formal channels to account to shareholders and stakeholders particularly:

Annual General Meeting

- Primary engagement platform between the Board and the shareholders of the company

- 28-days notice was given for the AGM held on 26 May 2017

- Accessible venue at Sime Darby Convention Centre

- Attended by all Board members

- Business presentation by GCEO and active engagement during Q&A session

- Electronic poll voting on all resolutions and immediate announcement of results

Investor Relations

Conferences, non-deal roadshows, large group meetings and one-on-one meetings

Annual Analyst & Investor Day

| 28 November | Analyst & Investor Day Hilton Hotel, Kuala Lumpur |

One-On-One Meetings/Conferences

| 28 – 29 March | 20th Annual Asian Investment Conference Credit Suisse, Hong Kong |

| 6 - 7 June | Investment Forum Asia 2017 Nomura, Singapore |

| 29 June | Asia Yield 1x1 Forum JP Morgan, Tokyo |

| 6 – 7 September | Asia Pacific CEO-CFO Conference JP Morgan, New York |

| 13 – 14 September | Investors’ Forum 2017 CLSA, Hong Kong |

Non-deal roadshows and large group meetings

| 25 April | Kuala Lumpur Axiata CFO – Meet the analysts |

| 15 – 16 June | Kuala Lumpur CIMB |

| 19 – 20 July | London Deutsche Bank |

| 21 July | Edinburgh Deutsche Bank |

| 8 September | San Francisco JP Morgan |

| 1 December | Singapore BNP Paribas |

Entities Across Asia

MALAYSIA

Celcom Axiata Berhad

Year of Investment/Shareholding:

2008/100.0%

Main Office:

Menara Celcom No 82, Jalan Raja Muda Abdul Aziz 50300 Kuala Lumpur Malaysia

Telephone:

+603 2848 3511

Website:

www.celcom.com.my

Nature of Business:

Mobile

Customers:

9.5 Million

Technology Deployed:

GSM, GPRS, EDGE, 3G, HSPA+, 4G LTE, LTEADVANCED, FIXED BROADBAND (SABAH)

No. of BTS:

33,000

Network Coverage (by population and technology):

2G-95.0%

3G-92.4%

4G-86.9%

INDONESIA

PT XL Axiata Tbk.

Year of Investment/Shareholding:

2005/66.4%

Main Office:

XL Axiata Tower Jl. HR Rasuna Said X5 Kav. 11-12 Kuningan Timur-Setiabudi Jakarta 12950 Indonesia

Telephone:

+62 21 576 1881

Website:

www.xl.co.id

Nature of Business:

Mobile Telecommunications and Multimedia Services

Customers:

53.5 Million

Technology Deployed:

GSM, GPRS, EDGE, 3G, HSPA+, DC-HSPA+, 4G LTE, 4.5G

No. of BTS (2G/3G):

83,666

No. of BTS (4G):

17,428

Network Coverage (by population and technology):

2G-93%

3G-92%

4G-85%

SRI LANKA

Dialog Axiata PLC

Year of Investment/Shareholding:

1995/83.3%

Main Office:

No. 475, Union Place Colombo 2 Sri Lanka

Telephone:

+94 777 678 700

Website:

www.dialog.lk

Nature of Business:

Communication Services, Telecommunications Infrastructure Services, Media and Digital Services including Financial Services and Business Process Outsourcing Services

Customers

12.8 Million

Technology Deployed:

GSM, GPRS, EDGE, 3G, HSPA, 4G LTE (FDD) WiFi, VoLTE, CDMA 2000, WiMAX, 4G LTE (TDD), GPON, XGPON, DTH, IPTV, OTT, MPEG-4, HEVC, SD, HD, 4.5G, NB-IoT

No. of BTS (2G/3G/4GFDD/TDD):

11,473

Network Coverage (by population and technology):

2G-97%

3G-86%

4G FDD-43%

4G-TDD-53%

BANGLADESH

Robi Axiata Limited

Main Office:

53 Gulshan South Avenue Gulshan-1 Dhaka-1212 Bangladesh

Telephone:

+ 88 02 9887146 52

Website:

www.robi.com.bd

Year of Investment/ Shareholding:

1996/68.7%

Nature of Business:

Mobile Telecom Operator

Customers:

42.9 Million

Technology Deployed:

GSM, GPRS, EDGE, HSPA+, 3G

No. of BTS:

16,199

Network Coverage (by population and technology):

2G-99%

3.5G-29%

CAMBODIA

Smart Axiata Co., Ltd.

Year of Investment/Shareholding:

2013/82.5%

Main Office:

464A Monivong Blvd Sangkat Tonle Bassac Khan Chamkarmorn Phnom Penh Kingdom of Cambodia

Telephone:

+855 10 201 000

Website:

www.smart.com.kh

Nature of Business:

Mobile Telecom Operator

Customers:

7.3 Million

Technology Deployed:

GSM, GPRS, EDGE, 3G, HSPA+, 4G LTE, 4G+, VoLTE, 4,5G

No. of BTS:

2G-2,279

3G-2,332

4G-2,069

Network Coverage (by population and technology):

2G-98.6%

3G-73.0%

4G-66.1%

NEPAL

Ncell Private Limited

Year of Investment/Shareholding:

2016/80.0%

Main Office:

Lalitpur Sub-Metropolitan City Ward no.4 Nakkhu, Nepal

Telephone:

+977 9805554444

Website:

www.ncell.axiata.com

Nature of Business:

Mobile Telecom

Operator

Customers:

16.4 Million

Technology Deployed:

GSM, GPRS, EDGE, HSPA+, 3G, 4G

No. of Sites (2G/3G/4G):

2G-3,324

3G-2,699

4G-916

Network Coverage (by population and technology):

2G-92.47%

3G-53.90%

4G-15.47%

MALAYSIA

edotco Group Sdn Bhd

Year of Investment/Shareholding:

2012/63.0%

Main Office:

Axiata Tower, Level 30

Telephone:

+603 2262 1388

Website:

www.edotcogroup.com

Nature of Business:

Telecommunications Infrastructure and Services

Axiata Business Services Sdn Bhd

Year of Investment/Shareholding:

2016/100.0%

Main Office:

Axiata Tower, Level 23

Telephone:

+603 2265 6800

Website:

www.xpand.asia

Nature of Business:

Enterprise Solutions/IoT

MALAYSIA

Axiata Digital Services Sdn Bhd

Year of Investment/Shareholding:

2014/100.0%

Main Office:

Axiata Tower, Level 32

Telephone:

+603 2260 9400

Website:

www.axiatadigital.com

http://www.ada-asia.com

www.apigate.com

www.myboost.com.my

Nature of Business:

Investment Holding and Operations of Digital Services

INDIA

Idea Cellular Limited

Year of Investment/Shareholding:

2008/16.3%

Main Office:

Birla Centurion, 10th Floor Century Mills Compound Pandurang Bhudkar Marg Worli, Mumbai 400030 India

Telephone:

+91 95 9400 4000

Website:

www.ideacellular.com

Nature of Business:

Mobile Services

Customers:

203.0 Million (VRC Customers)

SINGAPORE

M1 Limited

Year of Investment/Shareholding:

2005/28.7%

Main Office:

10 International Business Park Singapore 609928

Telephone:

+65 6655 1111

Website:

www.m1.com.sg

Nature of Business:

Mobile and Fixed Services

Customers:

2.2 Million